Simply How Much Is It to Start an LLC within the United States

Seeking knowledge on forming an Limited Liability Company in the USA and its associated costs involves understanding the basic setup costs, which range widely from as low as $40 in Kentucky to up to $500 in Massachusetts. These aren't the only expenses; operating an LLC often involves annual fees such as an $800 yearly franchise tax in California. Supplementary charges can include compliance agents and occupational permits. Evaluate regional costs because legal conformity is key to your LLC’s success. Thinking of the larger picture?

1. The Basics of Initial Fees

When registering an business, initial setup costs are a notable factor. These fluctuate by state. For example, in California, you’ll pay only $70, while in Texas, it's $300 total.

These costs cover the official documentation, which is mandatory. Some states also require an additional filing like a statement of information, costing about $20, as in Illinois.

Opting for priority processing may add more fees. Always check your state’s specific requirements to understand your total expenses.

2. Reviewing Annual Maintenance Fees

Recurring charges are key to keep your LLC active. These fees change per state and ensure status retention.

You’ll often encounter yearly reports, which range from $50 to $200. For instance, Delaware’s flat fee is $300, while California enforces an $800 yearly minimum.

Filing these reports involves updating your LLC’s data. Missing deadlines can result in penalties.

Also, registered agent services cost $100–$300 per year, whether you use an agency or self-represent.

3. Looking Into Additional Costs and Optional Services

Apart from the main setup fees, there are supplementary services and variable charges to consider.

A registered agent might charge $100–$300 per year, which more info ensures compliance and privacy.

Business licenses can cost between $50 and $500+, depending on the sector. You can get an EIN without charge from the IRS, but third-party services may charge around $75 to handle it for you.

Legal and accounting services can run $150–$400/hour. Expedited filing can add $50–$200.

Make a judgment call before investing in extras.

4. Cost Breakdown by State

LLC formation costs vary widely across states. For example, Kentucky is among the cheapest at $40, while Massachusetts has one of the highest at $500.

Arkansas offers a $50 filing, while California charges $70 plus $800/year.

Delaware requires $90 to start and $300/year. New York mandates a newspaper publication, which can increase costs substantially.

Know these details to avoid surprises.

Conclusion

Starting a Limited Liability Company in the USA involves dealing with initial costs between $40 to $500, and ongoing fees that fluctuate by state. You may pay extra for registered agent services, licenses, or compliance tools.

Being informed about your state’s rules helps you avoid penalties. With careful planning, you visit site can efficiently handle LLC formation costs in any U.S. state.

1

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Rick Moranis Then & Now!

Rick Moranis Then & Now! Michael Bower Then & Now!

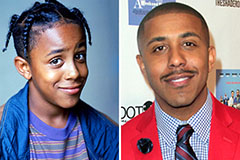

Michael Bower Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now!